If you’ve ever wondered, “Where did all my money go?”, you’re not alone! Those little expenses can add up fast if you’re not paying attention and wreak havoc on your finances. Ignoring the problem doesn’t make it go away. One of the best ways to improve your spending habits is to track every dollar you spend. I’ve created a simple printable spending tracker that you can get for free in this post. Taking a few minutes every day to fill out your spending tracker is an easy first step to improving your financial habits.

Find out how to use your own printable spending tracker and get the free printable below.

How This Spending Tracker Works

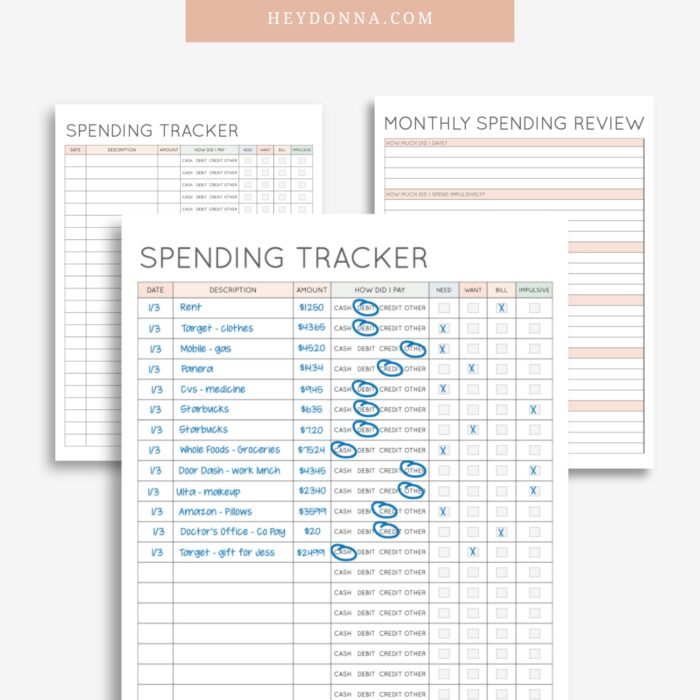

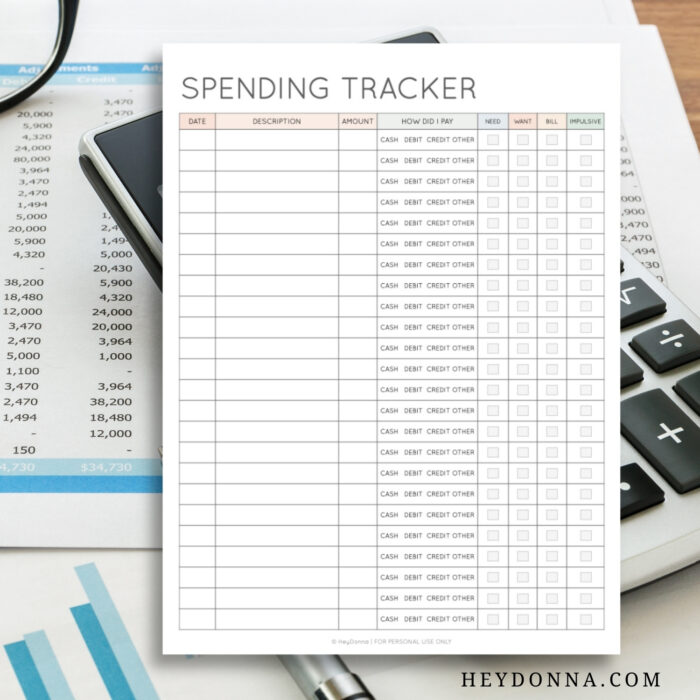

The tracker is designed to give you a clear picture of your spending habits. Each entry includes the date, a description of the expense, the amount spent, and the payment method (cash, debit, credit, or other). But what makes it extra useful is the categorization columns. For each purchase, you will track if the expense was a need, a want, a bill, or an impulsive buy. By visually marking each expense, you start recognizing patterns in your spending that might otherwise go unnoticed.

How to Use the Tracker Effectively

Not sure where to start? Here are a few simple steps:

- Log every purchase. Whether it’s a cup of coffee or your monthly rent, write it down!

- Be honest about categories. If something was an impulse buy, acknowledge it! Seeing impulsive spending in writing can be a real eye-opener.

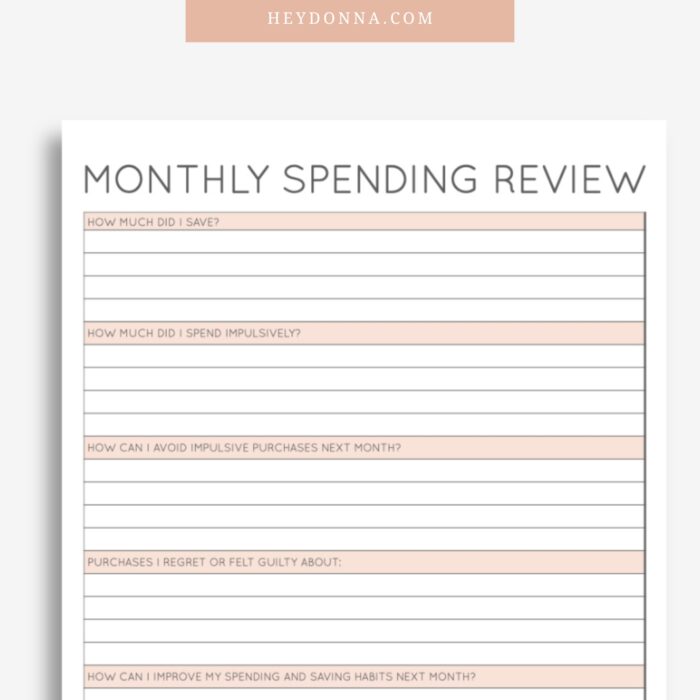

- Review at the end of the month. Use the Monthly Spending Review page to reflect on where your money went, how much you saved, and what changes you want to make.

- Set financial goals. Once you start to notice trends, like overspending on dining out, you can set a goal to cut back in that area next month. Sometimes you might decide to increase your monthly budget for that category instead, so you can better anticipate and prepare for that expense each month. It’s ok to give yourself permission to spend money too. Just be sure to include that in a budget so you can prepare for it.

Why This Spending Tracker is a Budget Must-Have

Using an app on your phone or computer can feel overcomplicated or make you feel disconnected from your money. For me, a physical paper tracker encourages me to slow down a little, engage with my spending habits, and take more responsibility. Writing each expense down is truly eye-opening!

A Real-Life Example

Imagine you’re planning a Disney trip (because let’s be real, I’m always planning one!). You use the tracker for a month and realize you’re spending $150 on takeout and coffee each week. By cutting that in half, you’ve saved over $300 in a month! That money can go toward your Disney fund instead!

Reflecting on Your Spending Habits

Tracking your purchases and expenses is the first step to improving your financial habits. One of the most important steps is taking the time to review your spending each month. I’ve also included a Monthly Spending Review page that you can use to break down your spending and take a moment to analyze your habits. Questions like: “How much did I spend impulsively?”, and “What purchases do I regret or feel guilty about?” can help you make small, changes that add up over time.

Get Started Tracking Your Spending with the free PDF

If you’re looking for a simple way to manage your money, this printable spending tracker is a great place to start. Download it, print it out, and start tracking today! You might be surprised at what you learn about your own spending habits—and how much easier it becomes to reach your financial goals.

Request Your Free Printable Files:

You should receive your file(s) link via e-mail within the hour. Be sure to check your spam or promotions folder if you cannot find the e-mail. If, after an hour, you have not received anything, contact me and I’ll help you figure out what happened. For personal use only. Please do not reproduce or redistribute without written permission. Classroom use is permitted.

Instructions on how to print and resize your printable to fit your own planner can be found here.

Leave a Reply