Find out how using sinking funds can help you avoid financial emergencies. We all have irregular expenses, the car breaks down, your dog gets hurt, you want to plan an anniversary trip, or a large bill (like car insurance) is due. These expenses are sometimes unexpected and many times you are not prepared. All of these financial situations don’t need to be emergencies. You need to have a plan.

I was never great with my finances when I was single. I had maxed out credit cards when I was 18 years old and only ever paid the minimum due. When my car insurance bill came I was always stressed out. I didn’t have a savings plan. It was a mess.

Getting married didn’t fix my bad habits.

I continued to struggle to stay above water for years. It wasn’t until we got aggressive and paid off all of our debt (for the first time) that I realized what kept causing us to have these financial emergencies. We were never prepared for these occasional expenses.

What are Sinking Funds?

Sinking Funds are like mini savings accounts for specific expenses or goals. You save money every paycheck for a specific expense. Your expense could be a planned expense like Christmas or your annual car insurance bill. They might also be irregular or emergency expenses like home repair, car maintenance, and veterinarian bills. This helps you to be ready when these expenses sneak up on you.

Before You Set Up Sinking Funds

Before we discuss sinking funds, I’m going to assume that you already have an emergency fund. If not I recommend that you prioritize saving at least $1000 for real emergencies. Not an “I-really-want-a-new-iPhone” fund. You need a true emergency fund that you can use if you have a car accident (and you need to pay a deductible) or an illness that makes you miss work unpaid. Once you have an emergency fund saved up you can move on and create your sinking funds.

Plan out your Sinking Funds

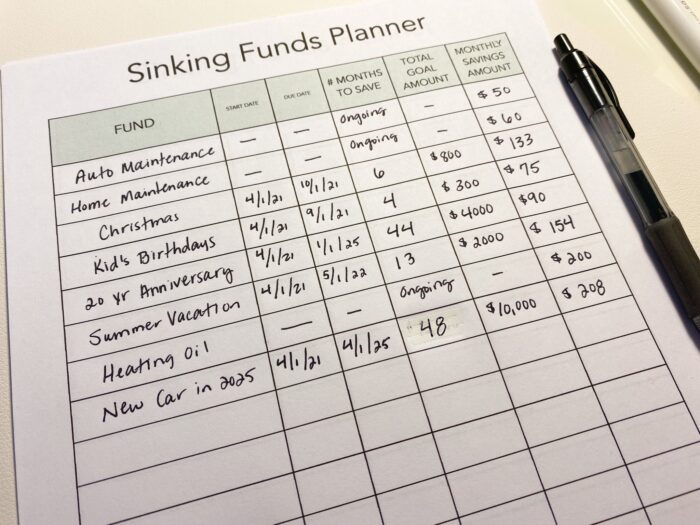

So you want to set up Sinking Funds. First you need to have a plan. What are you saving for? Is this expense a one-time or a yearly expense? Do you have a goal amount that you would like to save? What is the due date or when will you need to access the money?

For example, for Christmas savings, you will want to set a budget and have a due date of October or November so you can start shopping.

Print and use my Sinking Funds Planner Worksheet to help you plan out your sinking funds. You can get the worksheet at the bottom of this post.

Determine Which Categories You Want

There are many reasons you might want to set up sinking funds. Below is a list of sinking fund ideas that you might want to consider.

- Car Maintenance

- Home Maintenance

- HOA Dues

- Trash Bill

- Water Bill

- Medical/Dental/Vision

- Property Taxes

- Birthdays

- Christmas/other holidays

- Family Vacations

- Anniversary (trips or gifts)

- New Computer

- Furniture

- Heating Oil

- School tuition

- Kid’s Activities

- Wedding

- Memberships

Determine How Much You Need To Save

How much money do you want to save?

This was no small expense…it cost us over $500 to buy brand new tires. Ouch! 10 years ago this would have been an emergency. Because we use sinking funds we were able to have the cash we needed to buy the tires without going into debt or touching our emergency fund.

For our car maintenance account, we budgeted to spend about $600/year on our vehicles. So we save $50 a month. You might want to set a monthly amount to save just to have some money set aside or you may want to set a yearly goal. It depends on what your needs are.

Remember to account for any savings you might already have for your categories when you calculate the monthly savings.

Tracking Your Sinking Funds

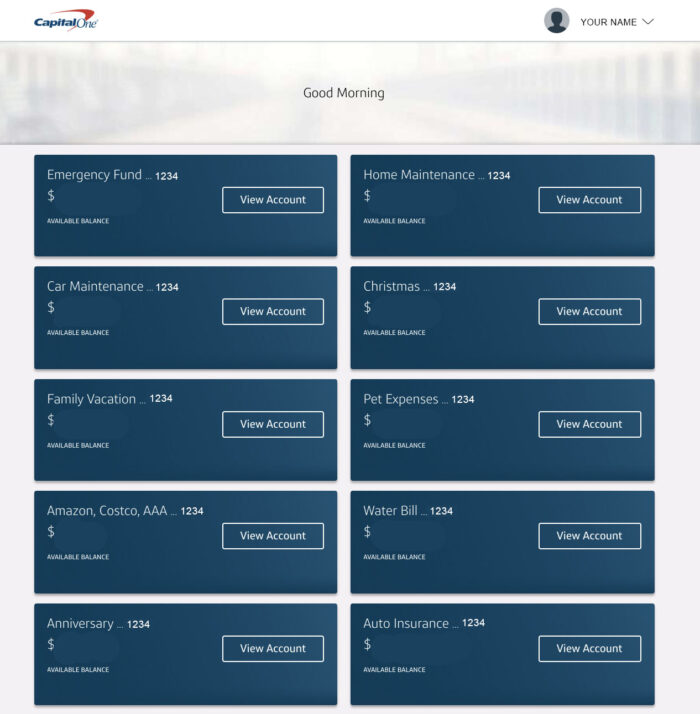

This is the one key to our success. For years, we have been using online savings accounts to track our sinking funds. We use Capital One 360 accounts for our savings. I’m able to name each account, transfer money from our checking account or even set up automatic transfers.

Having all of this information in one place keeps everything easy to track and manage. Having our accounts online, rather than at our local bank, helps to keep us from dipping into these savings account when we shouldn’t.

Transfers usually take only 2-3 days, so we are able to access our money very quickly. In the case of a real emergency, when we need access to our money immediately, we will use a credit card. Then I immediately go online and transfer the funds so that I can pay the credit card off once the money is deposited.

Automatic Contributions to Your Sinking Funds

Why We Love Capital One 360 Accounts?

- They are simple to set up. We don’t have to go into a bank and spend an hour setting up our account.

- We are able to see all of our balances on one page. This is HUGE. It is so helpful for me to see how much we have in each account at any time.

- We can’t touch the money – If this money was all in one big savings account I know that I would struggle to track it and not use it for other things.

- Automatic Contributions -We have automatic savings set up for some of our long-term savings goals.

Examples of Sinking Fund Goals

- Annual Car Insurance Bill $600. Save $11.54/week or about $50/month

- Christmas Budget $800/year. Save $15.38/week or about $66/month

- Water Bill $150/quarter – Save $12.50/week or about $50/month

- Heating Oil $1000/year – Save 20.83/week or about $83/month

- Big Disney Vacation in 5 years. $7000 goal. Save $26/week or about $117/month

- New MacBook in 2 years $2000. – Save$21/week or about $83/month

- New Car Tires in 6 months $500. – Save $20.83/week or about $83/month

Set up Your Sinking Funds with this Planning Worksheet

Fill out the form below to receive your free worksheet.

You should receive your file(s) link via e-mail within the hour. Be sure you check your SPAM or Promotions folder if you’re not finding the e-mail. If, after an hour, you have not received your link, please contact me and I’ll help you figure out what happened.

The fine print:

For personal use only. Please do not reproduce or redistribute without written permission. Classroom use is permitted.

S. Taylure

Hello.

Thank you for all your great spreadsheets. I was trying to request the sinking funds worksheet. However, it was never sent. Would you be able to assist?

Donna

Shannon, thanks for reaching out. I’m sorry you were having trouble receiving your free sinking funds worksheet. I sent you an email with the file. Please let me know if you have any trouble with it.